One of the great benefits of a properly funded living trust is the fact that it will avoid probate and minimize the expenses and delays associated with the settlement of your estate.

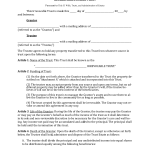

Georgia revocable living trust forms.

This type of entity provides flexibility for a grantor to specify where when how and to whom the assets and property are distributed.

It is your liability to meticulously examine the legal document and ensure that the alaska revocable living.

This revocable living trust form can be employed to form a trust that is able to be terminated or repealed by the grantor at any moment.

Georgia revocable living trust form.

The document selects a trustee to regulate the financial affairs of the trust during its existence.

This is one of the most popular types of trust.

A revocable trust can be altered or cancelled by you at any time you choose and becomes permanent after your death.

Your living trust is revocable which allows you to make changes and even to terminate it.

Downlaod this georgia revocable living trust form which allows a person known as the grantor to transfer property or assets into a separate legal entity for the benefit of the adobe pdf.

The georgia living trust is a legal form used when an individual wishes to dictate how their personal assets will be distributed after they die.

The georgia revocable living trust is a legal document that holds a person s assets and does not need to go through probate after the creator dies the person creating the document called the grantor appoints a trustee.

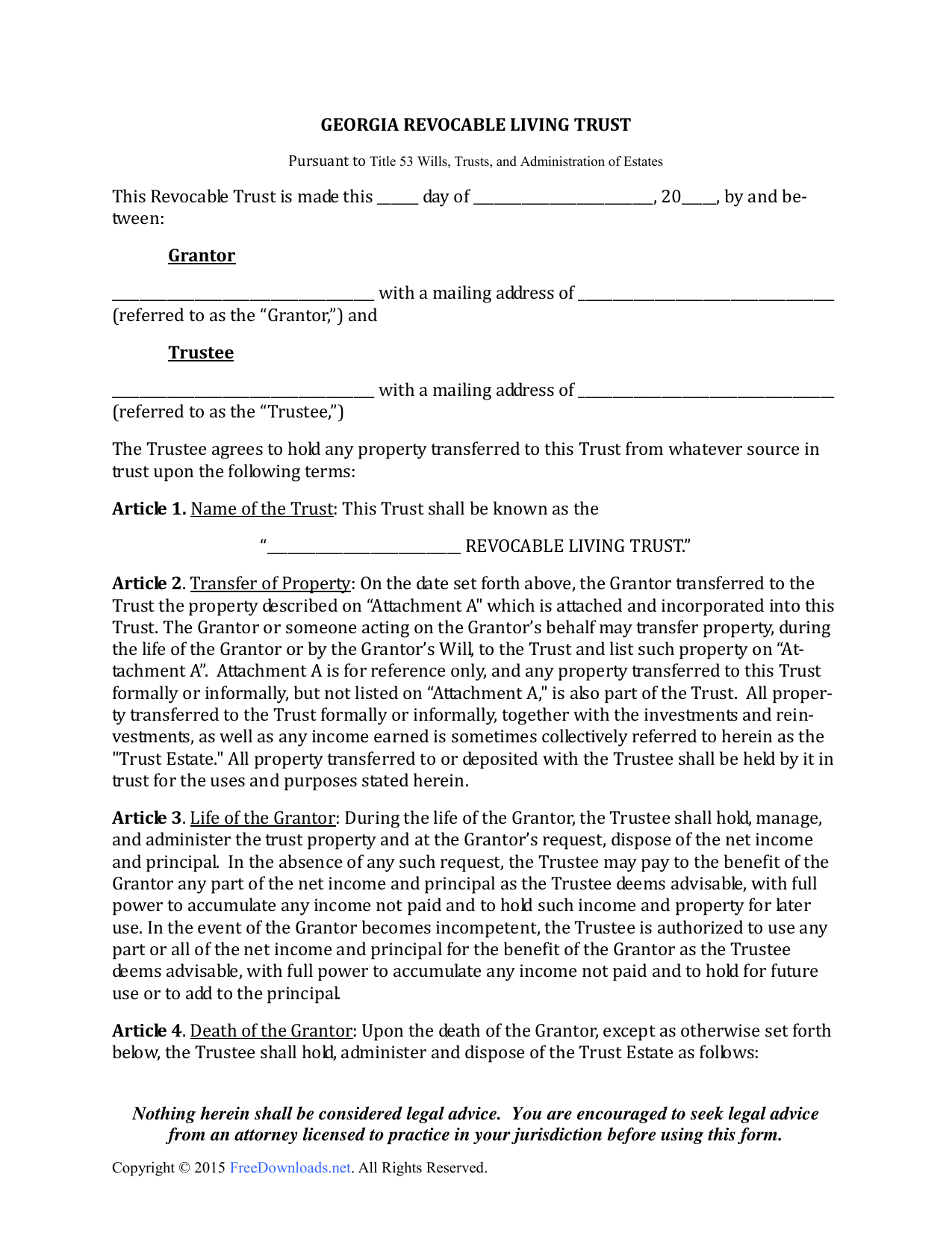

An irrevocable trust can never be altered and is a less common choice.

Downlaod this georgia revocable living trust form which allows a person known as the grantor to transfer property or assets into a separate legal entity for the benefit of the grantor s chosen recipients or benefciaries.

By creating a living trust you can also plan for an unfortunate situation.

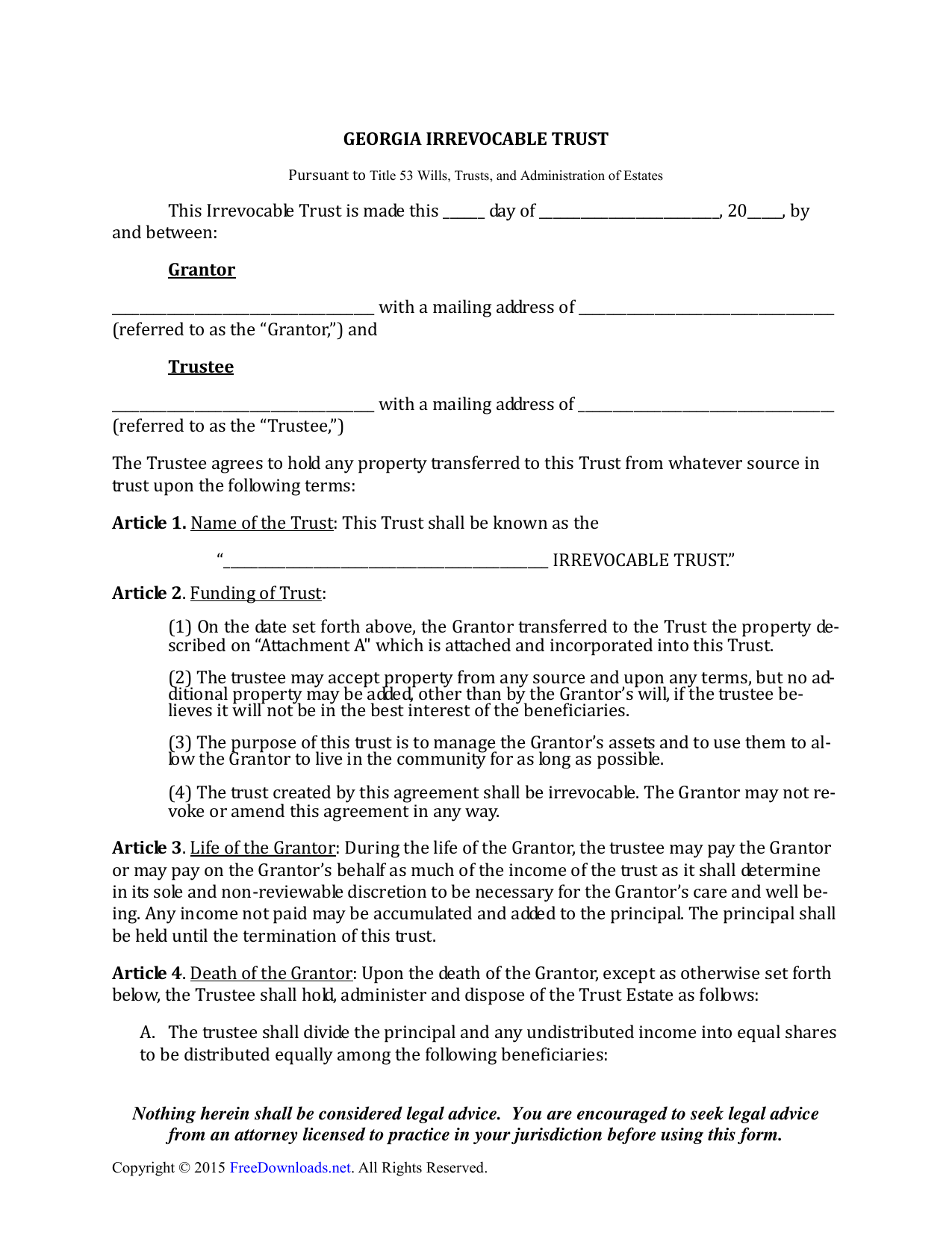

Decide what property to include in the trust.

Disadvantages of using a living trust in georgia.

How do i make a living trust in georgia.

Creating a living trust in georgia protects the assets in the trust from your surviving spouse if you wish to disinherit him or her.

To make a living trust in georgia you.

If you ever become mentally incapacitated the trust will provide for management of your assets.

Decide who will be the trust s beneficiaries who will get the trust property.

One of the drawbacks to using a living rust is that even if you have created a living trust you will still need a will.

A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning.

Create the trust document.

A living trust operates similarly to a will however unlike a will the items placed within the trust are not subject to the complex probate process.

The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary usually the creator of the trust settlor.

Choose whether to make an individual or shared trust.

:max_bytes(150000):strip_icc()/GettyImages-522015476-3749ef1cf84449cd9988a0dcbebe17a2.jpg)